In This article

Transaction monitoring is a crucial component of operational oversight in businesses that handle financial or point-of-sale (POS) transactions. It involves systematically observing and analyzing transaction data to detect abnormal patterns, prevent employee theft, and verify that staff follow established procedures. In environments with frequent cash handling or customer interaction, such as retail stores, restaurants, quick-service businesses, and convenience stores, transaction monitoring helps protect revenue and improve accountability.

At its core, transaction monitoring transforms raw POS data into actionable insight. Every sale, return, void, or discount creates a digital record. Monitoring software reviews these records in real time or through scheduled reporting to detect entries that deviate from expected behavior. These exceptions may be harmless in isolation, but are worth investigation when they appear in unusual frequency, timing, or volume.

Identifying High-Risk Behaviors using Transaction Monitoring

Examples of high-risk transactional behaviors include:

- Multiple refunds processed by the same employee in a short time period.

- Voided sales immediately following high-value transactions.

- Frequent use of “no sale” or open cash drawer actions.

- Transactions that occur during non-scheduled hours or without assigned shifts.

- Excessive manual price overrides, especially on high-ticket items.

- Transactions lacking associated inventory movement or sales receipts.

By identifying these behaviors quickly, businesses can reduce the window between incident and resolution, minimizing potential loss, addressing policy violations, and improving training outcomes.

Effective transaction monitoring platforms allow managers and loss prevention teams to:

- Flag suspicious transactions automatically using predefined rules or AI-based pattern recognition.

- Correlate transaction data with specific employees, registers, and shifts to identify trends.

- Link transactions to surveillance video to visually verify what occurred at the register.

- Export detailed reports for auditing, compliance reviews, or disciplinary documentation.

- Detect training gaps, such as repeated process errors, that may contribute to inaccurate or inefficient transactions.

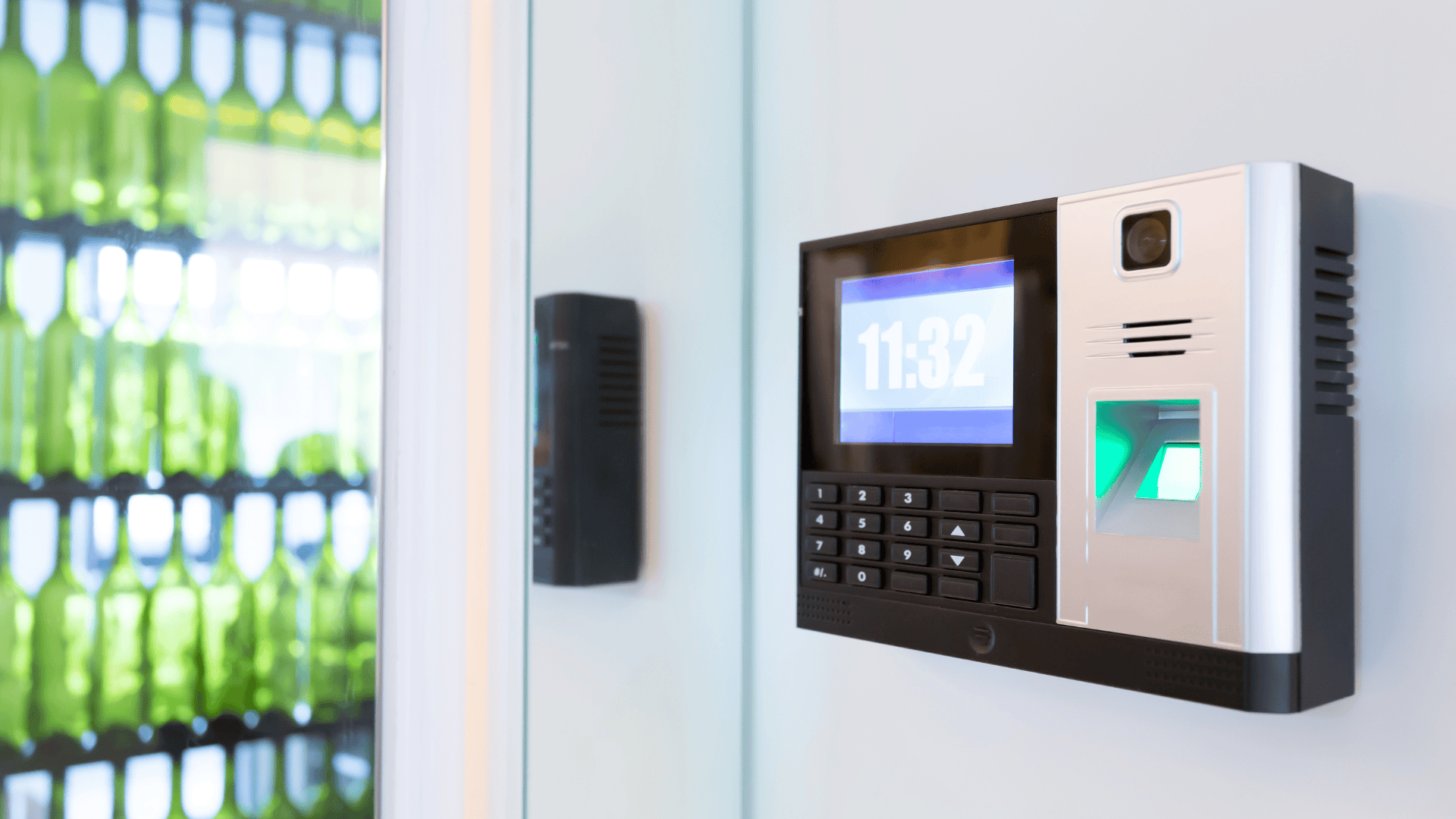

When combined with employee time and attendance data, access logs, and shift scheduling, transaction monitoring provides an even clearer picture of in-store behavior. For example, if an employee processes transactions outside their scheduled shift and access logs confirm they were in the building, that anomaly may require follow-up. Similarly, depending on context, a staff member with a higher-than-average return rate may need coaching, closer observation, or investigation.

How Transaction Monitoring Helps Business

Beyond loss prevention, transaction monitoring contributes to broader business objectives. It supports operational consistency across multiple locations, helps identify opportunities to improve customer service speed, and offers insight into how policies are applied in real-world conditions.

It can also help businesses:

- Maintain accurate financial records.

- Reduce time spent on manual reconciliation.

- Support compliance with industry regulations, such as tax documentation or age-restricted product handling.

- Promote a culture of accountability among frontline employees.

Whether used daily by store managers or reviewed periodically by district or regional leaders, transaction monitoring tools create a measurable impact when used proactively.

Transaction Monitoring with DTiQ

DTiQ’s 360iQ platform can monitor transactions and business operations by combining POS data with synchronized video footage and behavioral analytics. Whether investigating employee theft, reviewing procedural violations, or improving speed of service performance, DTiQ helps you connect every transaction with real-world context to protect profits and operate confidently. Want to learn more? Schedule a demo.