In This article

Fraud detection comprises a set of strategies, tools, and practices used to recognize unauthorized or dishonest actions that can negatively impact a company’s financial integrity. These actions may be internal, such as employee theft or manipulation of procedures, or external, like customer scams, theft, fake returns, or payment fraud.

For businesses in industries like retail, hospitality, food service, and logistics, fraud can happen across multiple touchpoints—including cash registers, inventory management, vendor relations, and digital payment systems. Fraud detection helps organizations identify suspicious patterns early, investigate incidents efficiently, and take preventive action to protect assets and operations.

While fraud detection has traditionally involved manual auditing and oversight, today it is often supported by technology such as surveillance footage, transaction analytics, and behavior recognition tools.

Common Types of Business Fraud

Fraud can take many forms depending on the industry and environment. Common examples include:

- Point-of-sale fraud: Voiding legitimate transactions, under-ringing items, or processing fake returns to steal cash or merchandise.

- Time theft: Clocking in for other employees, falsifying breaks, or spending time on non-work activities while on the clock.

- Inventory fraud: Concealing shrinkage, manipulating inventory counts, or colluding with vendors to misreport deliveries.

- Refund abuse: Customers returning used or stolen merchandise for store credit or cash.

- False discounts and coupon scams: Exploiting system loopholes or misusing employee discounts.

- Chargeback and payment fraud: Fraudulent use of credit cards followed by disputed transactions.

If not identified and addressed promptly, these types may result in financial loss, reputational damage, or even legal liability.

How Fraud Detection Works

Effective fraud detection involves a combination of monitoring, pattern recognition, and response mechanisms. Businesses may rely on:

- Transaction analytics: Reviewing point of sale (POS) data for suspicious trends, such as excessive refunds, frequent no-sales, or high void activity.

- Video surveillance: Linking footage to specific transactions or staff activity to verify behavior.

- AI-driven alerts: Using rules-based or machine learning systems to flag real-time anomalies.

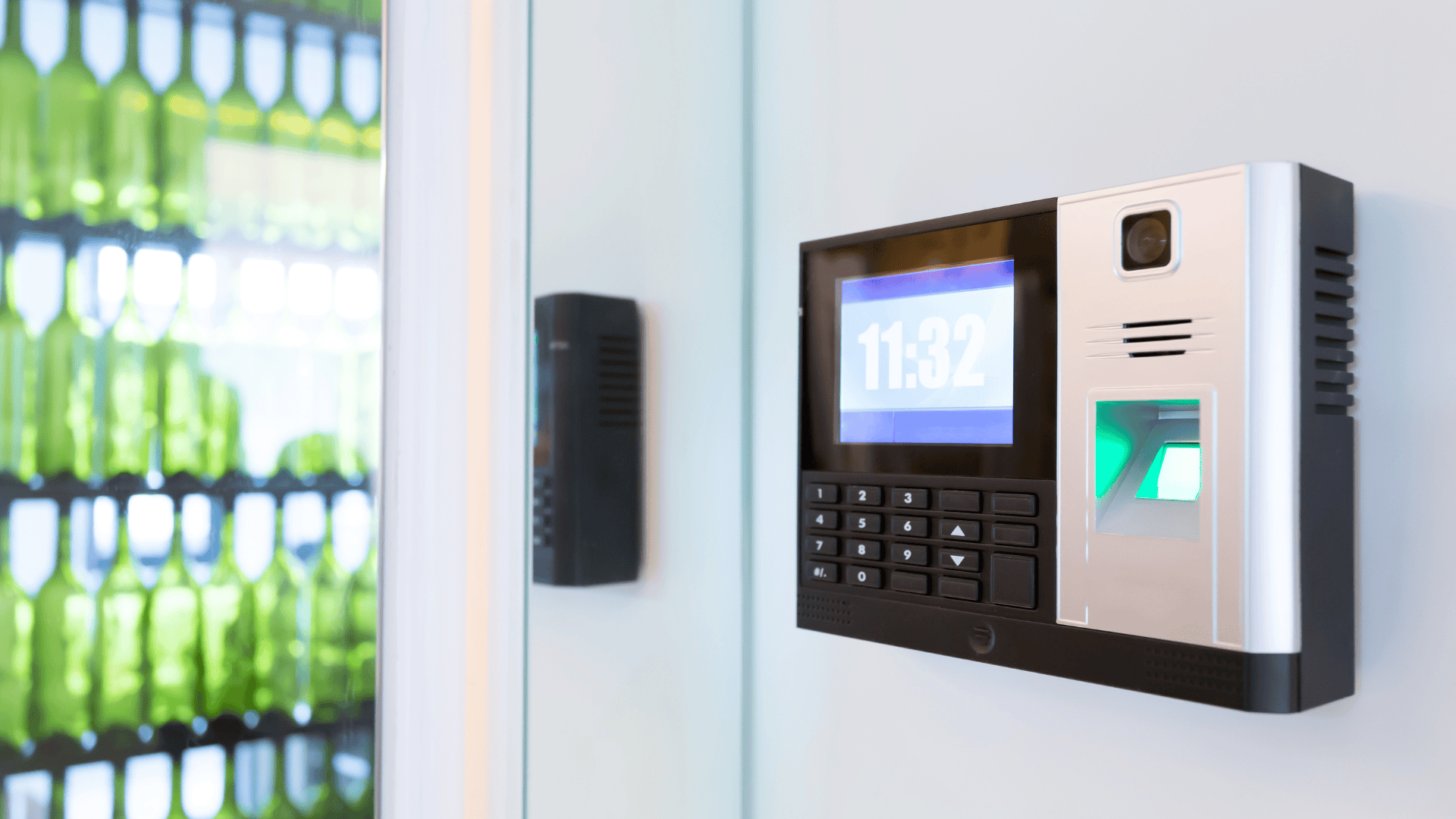

- Access logs and audit trails: Reviewing system access or restricted area entries.

- Employee performance tracking: Identifying irregular behavior or repeated issues tied to specific team members.

Fraud detection is most effective when systems are integrated. For example, a high number of late-night refunds tied to a particular employee can be flagged and then reviewed alongside video footage and transaction history.

Benefits of Fraud Detection

A strong fraud detection strategy supports:

- Financial protection is achieved by identifying losses early.

- Operational transparency across teams and locations.

- Employee accountability is achieved by connecting behavior to outcomes.

- Faster investigations with linked data and video evidence.

- Risk reduction across customer-facing and back-end processes.

Beyond catching incidents as they occur, fraud detection helps companies analyze long-term trends to strengthen internal controls and reduce vulnerabilities.

Protect Your Bottom Line with DTiQ

DTiQ loss prevention solutions empower businesses to detect and investigate fraud with real-time transaction monitoring, video integration, and behavior analytics. By connecting the dots between data and visual context, DTiQ makes it easier to spot suspicious activity, investigate efficiently, and reduce loss across all your locations. The DTiQ 360iQ platform gives you the information to respond quickly and stop fraud before it spreads.