In This article

Employee theft is one of the most common and costly forms of internal loss in the workplace. It encompasses a wide range of dishonest behaviors, involving employees exploiting their position or access to resources for personal gain. Unlike external theft, which comes from outside threats, this theft originates from individuals trusted to operate within the business.

The full impact of employee theft is often downplayed. In addition to the direct financial losses—through stolen inventory, fraudulent refunds, or cash skimming—it can damage workplace morale, erode trust, reduce profitability, and compromise the integrity of business operations. In some cases, it also exposes the company to legal liability, regulatory consequences, or reputational harm.

Types of Employee Theft

There are several categories of employee theft, including:

- Cash theft: Taking money from the register, safe, or petty cash fund, often through unauthorized voids, fake refunds, or under-ringing transactions.

- Inventory theft: The theft of physical goods such as merchandise, food, supplies, or equipment, sometimes for resale or personal use.

- Time theft: Logging of hours not worked, having another employee clock in on one’s behalf (buddy punching), or misusing company time for personal tasks.

- Service theft: Providing unauthorized discounts, freebies, or services to friends, family, or themselves.

- Data theft: Misusing or stealing sensitive customer, employee, or business information for personal benefit or third-party gain.

Warning Signs of Employee Theft

Employee theft may occur as isolated incidents or as part of longer-term schemes. It is often more challenging to detect than external theft because the perpetrators are familiar with internal controls and know how to manipulate systems without immediate suspicion.

Common warning signs of employee theft include:

- Frequent cash discrepancies or inventory shortages without explanation.

- Unusual transaction patterns include excessive voids, refunds, or no-sales.

- Resistance to oversight or unwillingness to share responsibilities.

- Declining profit margins without a clear operational cause.

- Behavioral changes include sudden defensiveness, secrecy, or unexplained financial improvement.

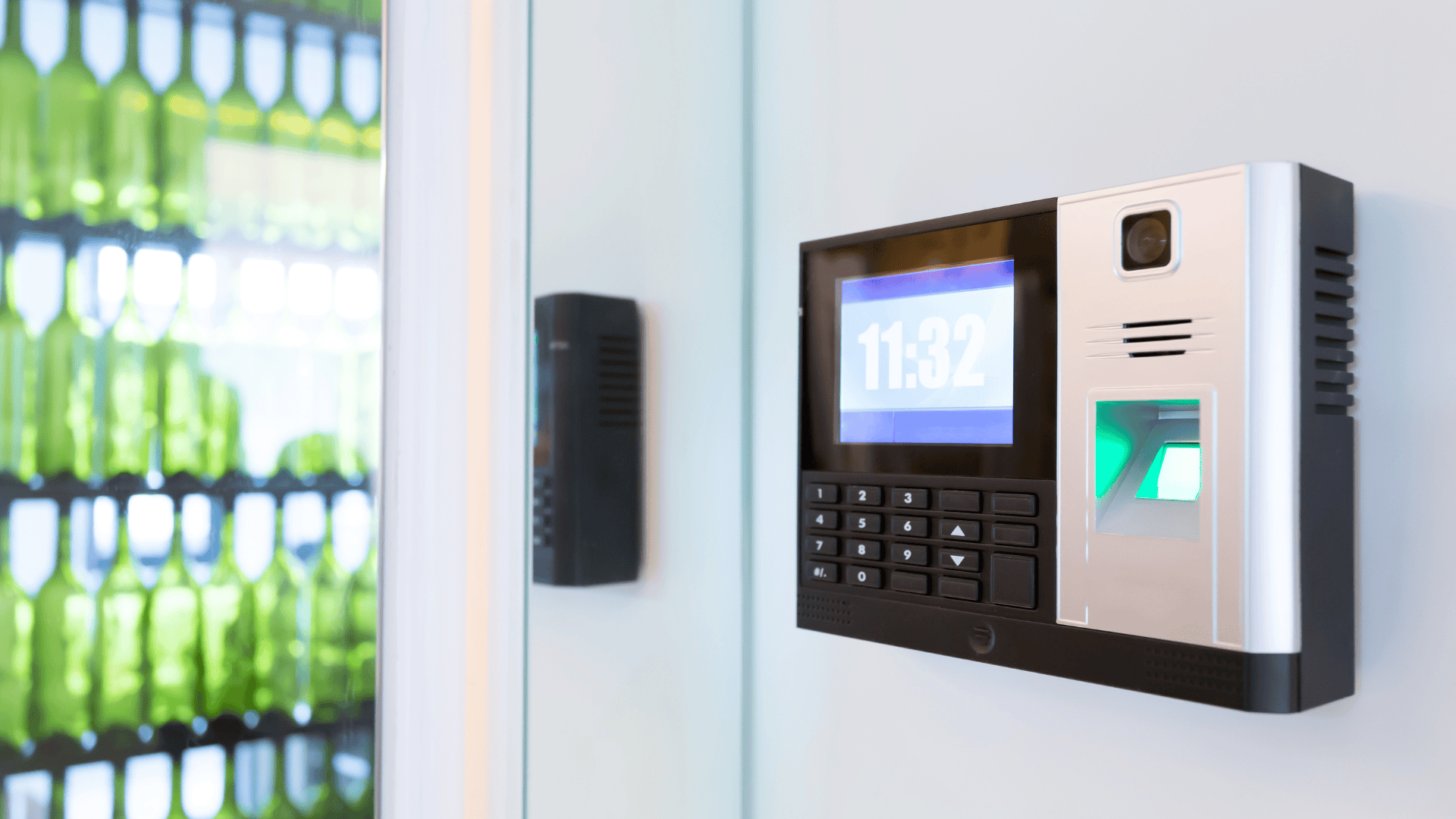

Businesses must rely on strong internal controls, clear policies, staff training, and surveillance to combat insider theft. Effective strategies often include regular audits, strict access control, separation of duties, and point-of-sale analytics to monitor suspicious behavior. Integrating these systems with video surveillance allows for quick investigation and visual confirmation of flagged transactions or activities.

Culture also plays a role. A workplace that promotes transparency, fairness, and accountability is less likely to tolerate or overlook unethical behavior. When expectations are communicated, employee activity is monitored, and measures are performed, company staff are more likely to follow procedures and report concerns when they arise.

Protect Your Business with DTiQ

DTiQ helps businesses detect, investigate, and reduce employee theft by integrating video surveillance, transaction monitoring, and behavioral analytics. Our 360iQ platform connects the dots between suspicious activity and supporting evidence, making identifying theft, documenting incidents, and taking appropriate action easier. Whether you’re protecting cash, inventory, or data, DTiQ gives you the visibility and tools to safeguard your business from the inside out. Contact us for more information.