In This article

Cash handling is a critical aspect of daily operations for businesses that accept physical currency. It involves the end-to-end management of cash transactions—from the moment money is received at the point of sale to when it is counted, secured, deposited, or transported off-site. Proper cash handling protects revenue, minimizes the risk of loss or theft, and supports financial accuracy and compliance.

The importance of cash handling goes beyond simply exchanging money. It is a structured process that includes front-end customer interactions and back-end procedures involving reconciliation, reporting, and banking. Without well-defined protocols, businesses can face increased vulnerability to internal theft, miscounts, customer disputes, and regulatory issues.

Effective Cash Handling Practices

Effective practices are guided by three main goals: accuracy, accountability, and security. To achieve these, organizations typically implement standardized procedures and provide training for employees who handle money as part of their duties.

A comprehensive cash handling process may include:

- Receive payment at the register, issue the correct change based on the cash tendered, and issue a receipt.

- Place money in the appropriate till slot and minimize cash exposure.

- Conducting till counts at the start and end of shifts.

- Performing cash drops into safes throughout the day to limit drawer totals.

- Reconciling totals with point of sale (POS) transaction logs and flagging discrepancies.

- Preparing end-of-day deposits for secure transfer to financial institutions.

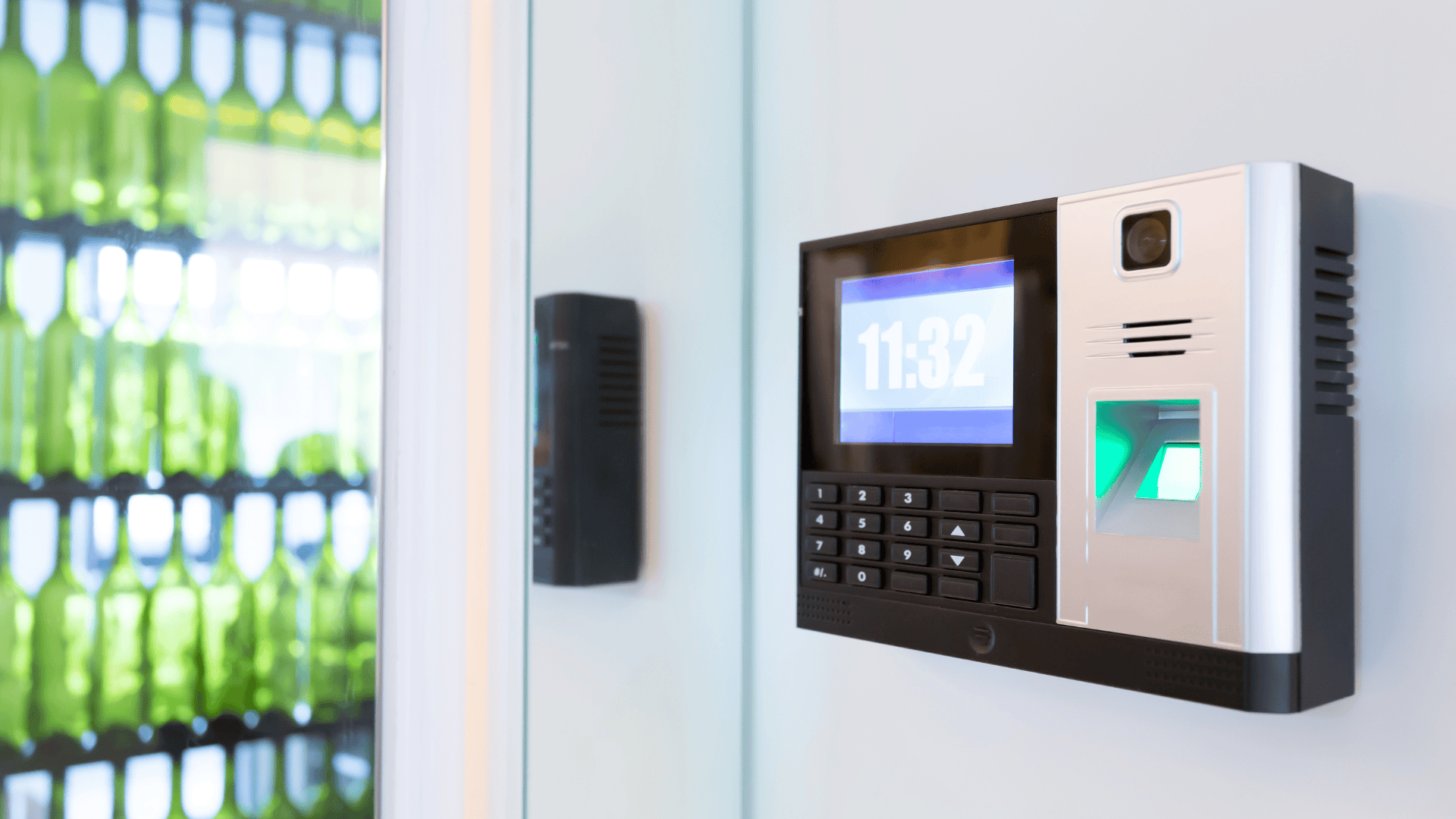

Audit trails, video surveillance, and restricted access to cash drawers and safes often support these steps. Surveillance systems are beneficial for verifying whether employees follow protocols, confirming cash drops, or investigating cash shortages.

Cash Handling Protocols

These protocols are often built into training programs in businesses with high cash volumes, such as convenience stores, quick-service restaurants, or retail stores. New employees learn to count money accurately, manage till balances, and report irregularities. Managers are trained in reconciliation and documentation, and corporate teams monitor store-level compliance through reports or integrated video review systems.

Consequences of Poor Cash Handling Practices

Poor cash handling can have significant consequences. Even minor discrepancies—if unchecked—can add to substantial losses over time. Inconsistent procedures may also lead to employee confusion, customer complaints, or allegations of dishonesty. A strong cash handling policy helps reduce these risks while building trust among staff and leadership.

Well-managed practices offer several operational advantages:

- Increased financial accuracy across shifts and locations.

- Improved accountability through tracking and documentation.

- Reduced exposure to internal theft and fraud.

- Faster resolution of disputes and discrepancies.

- Smoother bank reconciliation and reporting.

Cash Handling with DTiQ

DTiQ helps businesses with loss prevention solutions to protect against revenue loss and streamline operations by combining transaction data with real-time video verification. Our 360iQ platform allows you to monitor the cash register, confirm transactions, and investigate discrepancies—all from a centralized dashboard. With DTiQ, you gain the clarity and control to manage cash confidently across every shift and location. Contact us to learn more.